This is the second part of an overview on the development of the global pre-owned watch market. You can read part one here.

Watch marketplace Chrono24 is one of the most visited timepiece-related sites on the web. One of the reasons for its ubiquity is its promise to review all of its more than 2,000 dealers “based on a strict criteria before being allowed to list watches” on the site. Holger Felgner, the company’s co-CEO, explained the process like this: “Before their account is activated, all dealers must provide us with several official documents, including, for example, a copy of their ID and a trade license or excerpt from the commercial register. In some cases, we also ask that they have their identity confirmed by dealers who are already registered on Chrono24. Recommendations from other dealers are also an important aspect of our security policy. In addition, we offer various services to make buying and selling watches as easy and safe as possible, such as Trusted Checkout, Chrono24 Buyer Protection, and the Chrono24 Authenticity Guarantee.”

Chrono24’s fee is 2.85 percent of the listing price (to be paid by the seller), and the most expensive watch sold on the site so far has been a Patek Philippe Sky Moon Tourbillon “for more than one million USD.” Felgner also added that “with over 300,000 watches online,” the 2003- founded company had “the highest number of luxury watch offers available in the world” and “10 million watch enthusiasts who visit the site each month.” In comparison, eBay listed more than 100,000 pre-owned mechanical wristwatches in January 2018 alone and 1.4 million watches in total (of which more than 200,000 watches were listed in the mechanical category), while Swiss-based Chronext operates with 1,800 dealers with around 28,000 watches.

Tirath Kamdar, co-founder and CEO of online marketplace TrueFacet, is convinced that “the pre-owned watch and jewelry market has been plagued by opacity and uncertainty, with consumers not knowing if they are receiving a quality item at a fair price.” TrueFacet’s “product selection is authenticated by a network of highly skilled experts, both internal and external” with a team including “gemologists, factory trained watch technicians and experts drawn from the world’s leading horological auction houses.” These experts “check every detail of a piece before deeming it authentic and take into account such factors as model numbers, serial numbers, brand attributes, metal types, etc.” One result of this process: “A recent highlight was that we sold a hard to find MB&F Perpetual Calendar for $130,000. We’ve even had a customer some months ago checkout using their credit card for a $140,000 Patek Philippe Grand Complication.”

A similar approach is offered by “Authenticated Luxury Consignment” site TheRealReal: “50+ brand authenticators, gemologists, horologists and art curators inspect thousands of items each day.” Online marketplace StockX, with about 6,000 watches listed in January, describes its process like this: “Seller ships to us. We authenticate, then we release funds to the seller.”

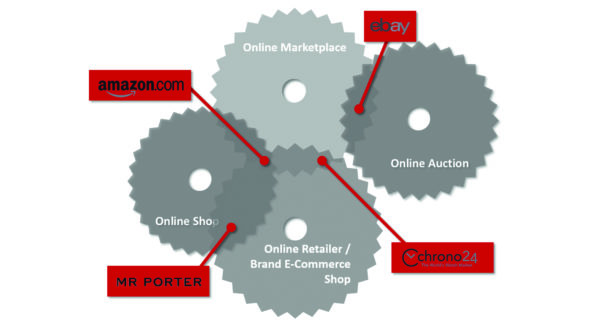

TrueFacet, like most of the sites, is free for buyers and pays its sellers up to 85 percent of the sale. The company was founded in 2013 and lists “over 80,000 pieces” on its site (with about 20,000 watches in January). The startup has already raised nearly $5 million in venture capital funding, while Chrono24 announced more than $20 million in raised capital in July 2015 to expand operations in the United States and Asia. (Chronext just raised more than the U.S. $30 million in January 2018.) More surprising, both Chrono24 and TrueFacet have already attracted a number of brands that officially partner with them. TrueFacet became an “authorized brand partner with 20 brands and growing” and Chrono24 lists watch brands such as “Benzinger, Louis Moinet, Moritz Grossmann, Frederique Constant, Porsche Design, Ateliers deMonaco, Linde Werdelin”– that don’t have a permanent physical store location. The two platforms also offer a number of worn and unworn watches from the brand’s current collections, whereas, for example, Mr Porter of the Yoox Net-a-Porter Group is an official online retailer for brands including Bell & Ross, Bremont, Montblanc, TAG Heuer, Panerai, Oris and Nomos and only carry new watches, which are often targeted at a younger audience. Kamdar confirmed this: TrueFacet’s platform “can help the brands reach the new generation consumer,” thanks to an average age of “35, with 28 percent under the age of 30.”

Certified Pre-Owned

For Tourneau, the largest luxury watch retailer in the United States and, according to the company’s website, also the “largest buyer of pre-owned timepieces in the United States,” the 2015 relaunched site acts as a hub between stores with pickup-in-store and ship-to-store options. In the pre-owned segment, Tourneau listed close to 1,500 watches on its site in January 2018, and states that “every pre-owned watch acquired by Tourneau goes through a comprehensive inspection process, followed by expert restoration using only original manufacture parts” at the company’s service center. In short, Tourneau promises to offer a risk-free one-stop solution to selling and buying a watch, thanks to providing several retail locations in real life and “a two-year warranty that covers internal movement defects” for every pre-owned watch sold. So, instead of focusing on facilitating a sale between a vendor and a buyer, like most of the online platforms, Tourneau is actually buying, servicing, storing and selling every watch listed and can, therefore, profit multiple times from every watch it buys or sells. (Note: In late January 2018, the Swiss watch retailer Bucherer finalized the purchase of Tourneau.)

New York-based Wempe Jewelers, on the other hand, “focuses exclusively on new timepieces – since 1878.” Ruediger Albers, President of American Wempe, believes that an emotional decision, like buying a watch or a piece of jewelry, deserves a lot more than clicking a button. “While it’s safe to say that all our clients are internet-savvy and well aware of pre-owned alternatives, our clients value and cherish the pleasure of the process, which at Wempe, is an indulgence – having an intelligent conversation with an informed and equally passionate watch sales expert in an environment that exudes luxury,” he says. “The peace of mind, the freedom from risk, the knowledge that Wempe stands 100 percent behind its products and will go to great length to ensure your happiness is our biggest differentiator.” He added, “Our almost non-existing return rate speaks volumes about the care my staff puts into finding the watch that’s right for you or your loved one rather than our bottom line.” And he sees another benefit: “We have seasoned master watchmakers right in the store with the proper training, which has earned us the official certification by the manufacturers, including Patek Philippe (one of just four in the U.S.), giving us access to spare parts that many others can only dream about.”

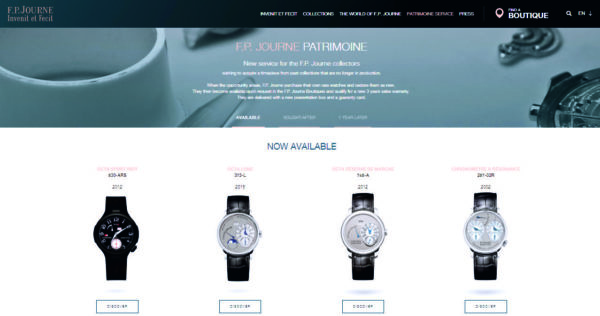

Speaking of seasoned watchmakers, in 2016, independent Swiss watchmaker F.P. Journe announced the launch of its own certified pre-owned program for watches “that are no longer in production.” Journe calls it “Patrimoine Service,” with around a dozen watches listed on the brand’s site in January 2018. The watches come with a new three-year sales warranty and are delivered with a new box and warranty card.

The interesting thing here is that F.P. Journe, like Tourneau, can now also influence the preowned market and make sure that current and future collectors receive the same quality from the brand, regardless of the age of a watch. And, on top of that, the company can even benefit several times from the sale of one watch and create a network for collectors.

Big Business, Big Data

More importantly, the knowledge gained from online transactions and interactions is bringing a new level of insights to the brands, shops, and collectors. “Our proprietary data collection method allows us to guarantee our clients fair market value pricing, where we have over 11,000 data points on how watches and jewelry trade in the market and use this to drive fair value to sellers and buyers,” explained Tirath Kamdar from TrueFacet. This means that there is basically no one more knowledgeable when it comes to customer demand than large e-commerce sites, especially when such sites offer a “my collection” or “wanted” section for registered users as well.

Philadelphia-based Govberg Jewelers’ latest venture, WatchBox, also accesses different data streams to determine and provide value and price development of mechanical wristwatches and aims to offer “secondary market pricing analysis, watch education, collection exploration and the latest news” in one central location.

A Holistic Approach for a Hybrid Consumer

Last November, Danny Govberg, CEO of Govberg Jewelers; Liam Wee Tay, former owner of Sincere Watch; and investor Justin Reis partnered to launch WatchBox, a global e-commerce platform for pre-owned luxury watches. CMIA Capital Partners, a Singapore-headquartered private equity firm, led an initial investment round in WatchBox of “over $100 million of capital to be deployed over the next 18 months.” Govberg and his partners, too, are convinced of “the power of pre-owned“ and, more importantly, of the potential, an “estimated $400 billion global pre-owned watch market” holds, and have launched a multi-channel platform that buys, services, sells and ships certified pre-owned watches. In other words, customers will always deal with the same partner, regardless if they are selling, trading or buying a watch. Danny Govberg says, “You buy a watch. And three years go by. You just decide you don’t like it, for whatever reason. You’ve kept it nice, you don’t want it anymore, you never planned on dying with it at the age of 100, but you just don’t like it anymore, so you want to sell it.” To do this, WatchBox customers can either initiate a dialogue via the app, site, phone, email, social media or even visit the company in real life. WatchBox currently operates dual headquarters, showrooms and “trading floors” or e-commerce centers in Hong Kong and in Philadelphia. “People flew in from North Carolina to get a picture with one of our guys [the commission-based traders working at WatchBox].”

Danny Govberg is convinced that “the number one luxury today is time. Nobody has it. So you have to put the saving of time into the business model, because a lot of wealthy consumers and a lot of consumers in general, want to save time.” And, of course, in building trust, regardless of the channel: “I could meet you here, on an airplane, at a factory tour; I could meet you at a golf outing, and we talk a little bit. You may never come in the store, but I have gotten to the ultimate level of trust; I’ve met you. And then you may call me on the phone, and say, ‘Hey, Danny, my son wants that watch.’” So far, Govberg has managed to transform this trust into transactions worth up to U.S. $1.6 million for a single watch and is now starting to expand globally. “We have 100 million dollars to go buy watches,” he says.

Amanda Ellison, President of Govberg Jewelers and WatchBox, also believes in hybrid customer experiences and, therefore, that online retail requires real interactions. “We look to combine the ease of online shopping with the human touch of the retail experience. A platform is a platform is a platform. Amazon is Amazon; the human touch element is really not there. It’s just very, very transactional, nothing more, nothing less. From that perspective, I think we differ.”

But, unlike most e-commerce sites offering luxury watches, WatchBox also operates on eBay. “We love eBay because we are platform agnostic,” explains Danny Govberg. “When you’re at Govberg or WatchBox on eBay, the watches are mint. We bring them back to mint. When you buy on eBay, 90 percent of the watches on eBay are just as you see them. And then, when the customer checks out who we really are, then they see that we’re an authorized dealer.”

The Next Generation

Over the last 20 years, the internet has helped create a global marketplace for mechanical watches that have already been sold at least once. It has also created a better connected, better-informed generation of consumers, that doesn’t solely rely on a physical store, but can easily switch between on and offline channels, new, pre-owned, and vintage watches.

And it seems that brands, too, are starting to realize that in the digital age of transparency, watches from the company’s past often have an impact on the brand’s image today (and vice-versa), in regard to how collectors perceive a brand and whether watches keep their value, and not just when it’s about another ultra-rare model in an auction or re-edition. If a collector can sell a watch at a profit, he’ll most likely return to the brand at some point in the future or at least recommend it to other collectors. In short, the pre-owned market is starting to be seen as an opportunity and not just as another threat.

But even though the watch industry has undoubtedly been disrupted by the internet (and everything it has brought), the fundamental rules of business haven’t changed much in the last 20 years for anyone looking to sell or buy a watch. Trust has always been the basis for any transaction, and the new players like Chronext, Chrono24, TrueFacet or WatchBox seem to have understood that, as have some established retailers like Wempe. The real challenge for both, perhaps, will be to create a personalized customer experience based on data (or knowledge) that is as exciting and exclusive as the product – regardless of whether it’s an offline or online boutique visit, an email, a phone call or a live chat.

Hello there, I uncovered your web site by way of Bing at the same time looking for a similar matter, your website showed up, this indicates excellent. I’ve got included with favorites|added to my favorites.

Roger, a fantastic piece with lots of places I have personally traded in and new ones to try out – so thank you. Speaking as a pre-owner watch addict my thrill is in the chase – the discovery, the research, the travel and meeting people on the way. Of course trust has to be an integral part of it. I still feel the human element is the final reason when I choose to buy or pass on an opportunity. But that is just me.